Dernière actualisation le 04 May 2022

How to report your cryptocurrencies?

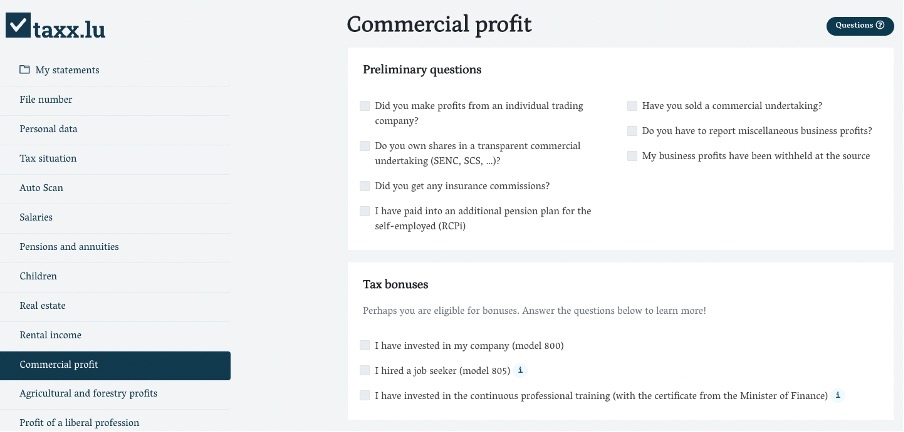

If buying and selling crypto currencies is your main activity, then please report this income in the category "Commercial profit".

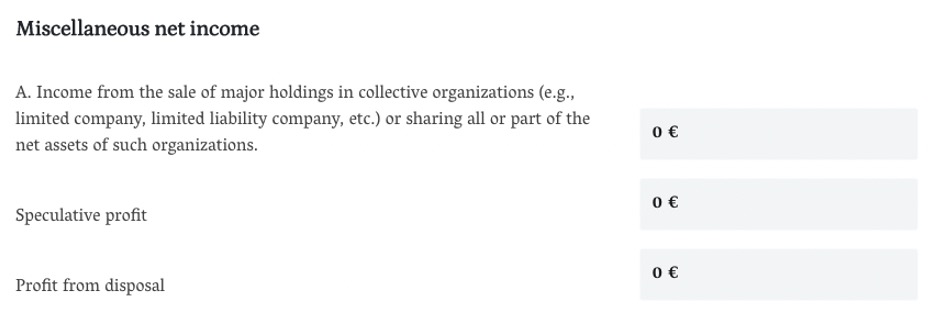

Otherwise, please report your crypto currency income in the category Investment in Securities > Miscellaneous net income > Speculative profit.

The activities of transferring and mining a virtual currency are subject to potential taxation as soon as income is generated.

If a virtual currency is exchanged for another virtual currency or for euros or another monetary currency, it is considered as a sale for value of the virtual currency followed by the acquisition for value of the other currency. The gain from the sale would therefore be subject to potential taxation.

To be considered as a miscellaneous net income, the income from virtual currencies must be a speculative profit, i.e., the period between the purchase and sale of these virtual currencies is less than 6 months.

This speculative profit will be taxed on a progressive scale.

If the crypto currency was held for more than 6 months before resale, the income from this sale is not subject to taxation. Similarly, if the total annual profit (considering gains and losses from speculation) does not exceed 500 euros, then this profit is not subject to taxation.