No need to be a tax expert to file your tax return!

Resident or cross-border commuters, complete your tax return on taxx.lu and take advantage of various benefits!

File nowThe leader in online tax filing in Luxembourg

On your side since 2018 with:

145.801.004€

Tax refunds

100.075

Satisfied users

Save time. Save money. Save stress.

Why choose taxx.lu?

1. Save time

Save time and avoid manual input by importing automatically your tax certificates and the PDF form from your previous year's tax return.

The forms adapt automatically to your personal situation, and the deduction limits are calculated automatically.

Faster, more accurate and less headache.

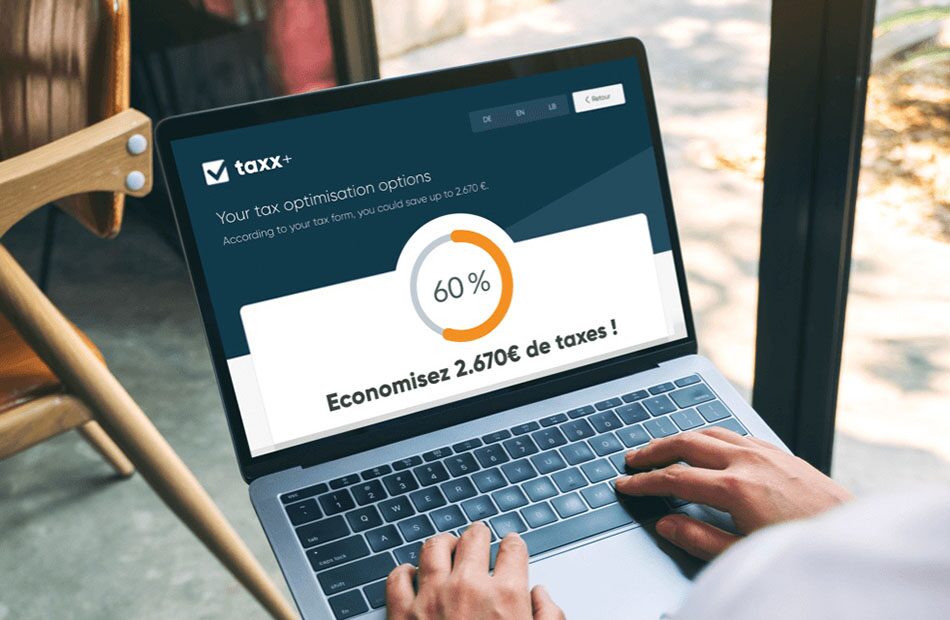

2. Save money

Reduce your taxes with our intelligent analysis of your tax return.

We identify possible deductions for you and show you at a glance your potential for optimisation, as well as the estimated amount to be recovered or paid.

It's clear, with no surprises, and easy to compare with the administration's calculation. You'll never miss out on the tax benefits to which you're entitled.

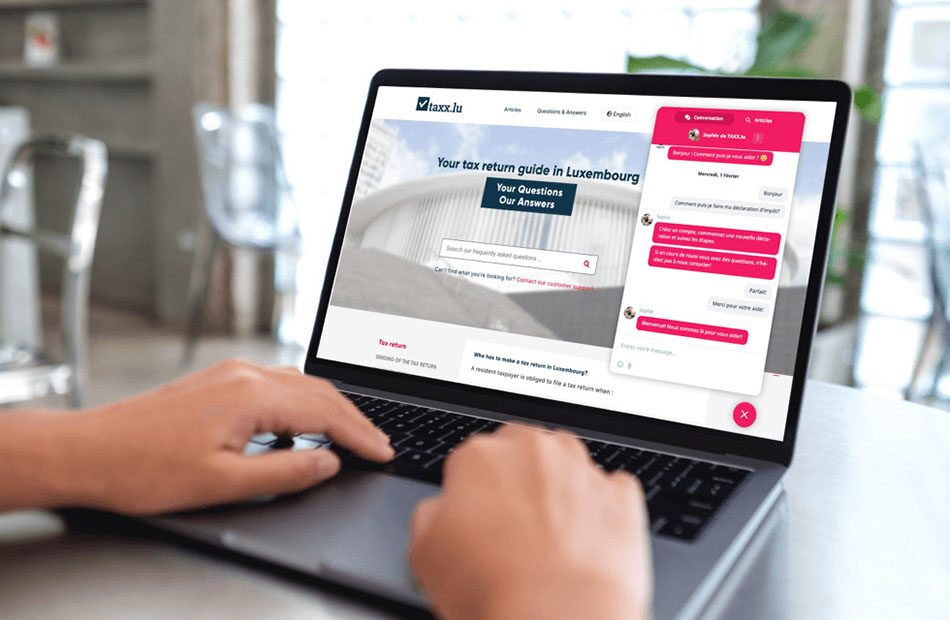

3. Save stress

Our customer support team is with you every step of the way.

Whether you are a resident or a cross-border commuter, our team will respond quickly and guide you according to your personal situation.

Do you have any doubts? Consult our many Q&A's and articles available at any time.

You can move forward with peace of mind, safe in the knowledge that you're well looked after.

Test for free

Create an account, complete your return and simulate your tax refund!

Create an accountThey trust us

Complete your tax return in 4 easy steps

-

1. Import your data

Import your tax certificates, the Auto Scan function will automatically complete your tax return.

-

2. Check & complete

Check and complete your personal data while being guided step by step.

-

3. Download your tax return

Download your tax return ready to send to the tax authorities.

-

4. Reduce your taxes

Discover your tax optimisation potential with Opti-Score and reduce your taxes.

Expert verification

Still in doubt? Our experts can check your tax return to make sure everything is correct.

How does a verification work?Need more help?

Have a look at our Q&A and articles, or contact our customer support team if you have any further questions..

Contact supportFind the right plan for you

Discover our various offers here.Standard Package

69,00€

- Tax return

- Annual adjustment

- Annexes

- Personalised tax optimisation analysis

Plus Package

119,00€

- Standard Package

- Verification by our experts

- Verification of the tax assessment

- Letter for reconsideration

Premium Package

199,00€

- Plus Package

- Video call appointment

- Printing and preparing for filing (on request)

Tax simulators

Simplify your search for important information with the taxx.lu simulation tools.

Outstanding Balance Insurance

Calculate your tax deduction for your mortgage insurance.

Our simulator helps you choose the ideal insurance premium to protect your family and your assets.

Travel Expenses

Check your travel expenses easily and avoid costly mistakes.

Our simulator will help you check if the distances involved and the flat-rate amounts applied are correct.

Discover all the other essential simulators.

To all simulatorsHow can you save on taxes?

Optimise your taxes in Luxembourg and get money back easily.

Private pension plan

A private pension plan allows you to reduce your taxes today and benefit from additional income in the future.

Learn moreHome savings plan

Take advantage of tax benefits by saving for the purchase or renovation of your home.

Learn morePrivate Health Insurance

A financial safety net for medical care, for you and your family.

Learn moreOutstanding Balance Insurance

Protect your loved ones by covering your mortgage in case of death or disability.

Learn moreExplore all the options and opportunities to reduce your taxes.

All tax optimisation optionsOur partners section

Articles & tips

Find answers to all your questions about taxation in Luxembourg!

Frequently Asked Questions

All the answers to your questions about tax in Luxembourg.