Last updated on 10 May 2022

Liberal professions, secondary activities: how to declare your income?

Go to the category Tax situation > Non-salaried income > tick the box “A member of the household has practised a liberal profession” and save.

Then, go to the category Profit of a liberal profession and tick the box “Did you make a profit from an individual profession?”, then click on “Add a profit”.

You'll then have the choice:

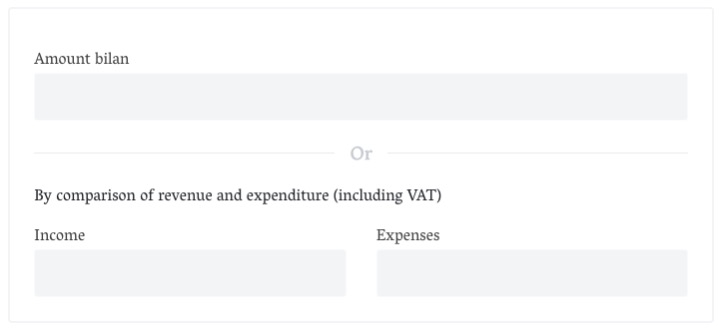

- You can directly add the amount of taxable income in the "Amount bilan" field.

OR

- You can add the amount of income on one side and the amount of expenses on the other. To justify your expenses, please fill in form 152 and enter the amount in the "Expenses" field.

For lawyers, please fill out form 153.